A PLACE OF OUR OWN

Our purpose is to empower members with personalized financial solutions, education, and caring service that build confidence and lasting relationships. We recognize that each member’s financial journey is unique, and we are dedicated to walking alongside you—offering guidance, support, and real solutions.

As the world evolves, so do we—combining innovation with genuine connection—to meet your needs today and tomorrow.

CHAIR MESSAGE

Dear fellow members, board of directors, friends, and colleagues,

As the new Chair of the Board of OAS FCU, I am honored to serve this cooperative community—a community where members find refuge, support, and tangible solutions to the financial challenges they face.

Reflecting on the past year, I am proud to share the significant milestones and accomplishments we achieved together, even as financial, social, and political systems were tested globally. This year has been one of transition, growth, and adaptability, made possible by the dedication of our Board, staff, volunteers, and management.

PART OF EVERY STORY

Whether you’re starting your first job, managing unexpected expenses, or planning for retirement, we listen first and act with empathy. Our services—from flexible loans to financial counseling—are designed to fit your life, not the other way around.

Every day, we honor the stories of our members by offering more than accounts and transactions—we offer understanding, respect, and partnership.

CEO'S MESSAGE

Dear members of OAS FCU:

Once again, I am proud to provide you with a yearly review of our Credit Union. 2024 was not an easy year for most financial institutions, organizations, and businesses overall in the United States. The changing regulatory and political environment, volatile markets, and the overall global attempts to settle into a new way of doing things post-pandemic proved to be a challenge for everyone, one that took (and continues to) a toll.

New Members Joined

Open rate on marketing emails

Financial Education Engagement*

* Over half of our members actively engaged with our educational content

Number of paper sheets saved

through electronic applications

Empowering Members: Digital Support & Personalized Financial Guidance

Confidential, no-cost financial counseling sessions help members identify strategies to lower interest rates and monthly payments, promoting sustainable financial wellness and empowering better money management.

Boosting financial resilience via holistic counseling and education services

Number of Loans Disbursed

Loan amount disbursed

Total Loan Portfolio

CREDIT COMMITTEE REPORT

The Credit Committee is pleased to report that during 2024, 1,893 loans were disbursed, totaling $27.67 million. While this represents a decrease compared to 2023, when 2,050 loans totaling $39.45 million were issued, the numbers reflect a strategic and member-focused approach in a tightening economic climate. The global rise in interest rates and shifting consumer behavior contributed to this decline, but our priority remained constant: providing responsible, need-based lending that supports our members’ well-being.

BEYOND BANKING: ALLIES FOR LIFE

At OAS FCU, we understand that money touches every part of life, and we are here to offer steady support through all seasons. Whether you need advice on budgeting, want to explore loan options, or seek guidance on protecting your identity, our team is ready to listen and help.

With us by your side, you never have to face challenges alone. Reach out anytime—we’re here for you.

SUPERVISORY COMMITTEE REPORT

The Board of Directors of OAS FCU entrusts the Supervisory Committee with two critical responsibilities among others:

• To ensure that Credit Union management reports faithfully and clearly on the financial condition of OAS FCU.

• To verify that the policies, procedures, and practices of the Credit Union are effective in protecting the assets of our members.

CONTINUING OUR PROMISE

We remain open to every story, walking alongside you into tomorrow.

As we look toward the future, one thing remains constant: our doors and hearts stay open to all members, now and for generations to come.

Together, we will continue building an inclusive credit union where every voice matters and every member can walk their path to financial confidence. Our commitment to innovation, sustainability, and personalized service will guide us as we shape a future that reflects our shared values.

The journey ahead calls for collaboration and trust—and together, we will meet it with strength and hope.

OUR GREAT TEAM

your needs—not the other way around.

REAL SOLUTIONS FOR REAL LIFE

Number of Loans Disbursed

Loan amount disbursed

Total Loan Portfolio

CREDIT COMMITTEE REPORT

The Credit Committee is pleased to report that during 2024, 1,893 loans were disbursed, totaling $27.67 million. While this represents a decrease compared to 2023, when 2,050 loans totaling $39.45 million were issued, the numbers reflect a strategic and member-focused approach in a tightening economic climate. The global rise in interest rates and shifting consumer behavior contributed to this decline, but our priority remained constant: providing responsible, need-based lending that supports our members’ well-being.

Loan amount disbursed

Total Loan Portfolio

CREDIT COMMITTEE REPORT

The Credit Committee is pleased to report that during 2024, 1,893 loans were disbursed, totaling $27.67 million. While this represents a decrease compared to 2023, when 2,050 loans totaling $39.45 million were issued, the numbers reflect a strategic and member-focused approach in a tightening economic climate. The global rise in interest rates and shifting consumer behavior contributed to this decline, but our priority remained constant: providing responsible, need-based lending that supports our members’ well-being.

Loans approved, including personal loans and debt consolidation

Members reached with financial counseling

Growth in our membership across the Americas

Loan applications

Loan Portfolio

Growth in our membership across the Americas

Growth in our membership across the Americas

CREDIT COMMITTEE REPORT

The Credit Committee is pleased to report that during 2024, 1,893 loans were disbursed, totaling $27.67 million. While this represents a decrease compared to 2023, when 2,050 loans totaling $39.45 million were issued, the numbers reflect a strategic and member-focused approach in a tightening economic climate. The global rise in interest rates and shifting consumer behavior contributed to this decline, but our priority remained constant: providing responsible, need-based lending that supports our members’ well-being.

CONTINUING OUR PROMISE

STRONG FINANCIALS

Special loan rates to finance green initiatives

Our Loan Program During Challenging Times

Shares: Competitive and diverse programs for the needs of our members

Kick-off Project

ENHANCING OUR MEMBERS' FINANCIAL WELL-BEING

CEO'S MESSAGE

Dear members of OAS FCU:

When reporting on our Credit Union for 2023, I consider last year to be one of survival to challenges and change. During the first full year after the COVID pandemic, OAS FCU faced many situations and tests that had a strong effect, not just on us as a financial institution, but on all of us, its members.

Last year many of us saw a change in our workstyles. The slow return to in-office work has affected both the membership and our staff, and we continue to work actively with everyone to ensure that we are always available to assist you, in person, by phone, or digitally.

BY YOUR SIDE, ALWAYS

Thank you for letting us walk this path with you.

OAS

$66M

CAF

$36M

IICA

$9M

NatGeo

$7M

IACHR

$4M

Others

$8M

OUR MISSION

OUR VISION

Dividends Paid to Members

Total Deposits

Total Shares

PART OF EVERY STORY

Kick-off Project

Our membership grew by 100% across the Americas.

CAF

$36M

IICA

$9M

**Life is unpredictable—our solutions can help you adapt and thrive..**

Lunched Product and Tools

Total Online Users

Domestic ACH and Wires

Online Transfers:

International ACH and Wires

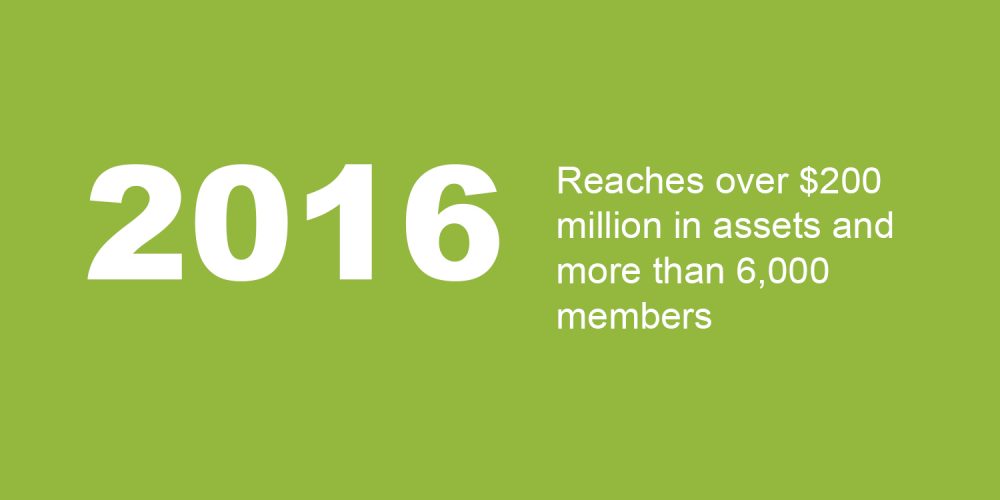

FINANCIAL STABILITY: AN INSTITUTION LIKE NO OTHER

Total Assets

Return on Assets

Total Loans grew

Total Deposits reached

Loan to Assets Ratio

Net worth ratio

Average growth per year, in the last 3 years

Total Assets grew to

Total Assets Increased by

Total Shares reached

Return on Assets

Net worth ratio

Other financials

A safe and secure institution that members can trust.

Like banks, deposits in credit unions are federally insured by NCUA's Share Insurance Fund for up to $250,000 per individual depositor. Also, know that credit union regulators require higher capital reserves than those required for banks –a requirement that reduces liquidity concerns.

A not-for-profit member-owned cooperative.

As a cooperative, we are accountable to our 8,622 members rather than to unknown stockholders. We use our revenue to benefit you by offering market-leading products that are safe and support our stability, making us much less likely to falter during major market fluctuations or regulatory changes in the industry.

A diverse, healthy balance sheet.

Our priorities are aligned with those of our members. This is why we take a conservative approach to managing our members' deposits. We choose a lower-risk investment strategy and do not engage in risky practices to meet stockholders' profit demands. Instead, our portfolio is diverse and not dependent on a sole industry.

At OAS FCU, we understand that money touches every part of life, and we are here to offer steady support through all seasons. Whether you need advice on budgeting, want to explore loan options, or seek guidance on protecting your identity, our team is ready to listen and help.

With us by your side, you never have to face challenges alone. Reach out anytime—we’re here for you.

Loans

Loan Portfolio Growth

CREDIT COMMITTEE REPORT

Total Deposits

Total Assets

Total Loans

Total Loan to assets

Loan Disbursed

We have always cared for our members, the communities we serve, and the staff and volunteers that help us provide it. We have added our planet to the list of those we serve and care for, and from now on we will help protect it, and hope we set an example for others.

Total Online Users

Domestic ACH and Wires

Online Transfers

International ACH and Wires

Debit Card transactions

Remote Deposits

Total number of applications and requests completed electronically via DocuSign

Environmental Savings using DocuSign

OAS FCU headquarters outperforms 86% of similar buildings nationwide. It also uses 43% less energy per square foot than the national average.

ENERGY STAR

Certified Building 2023

OAS FCU headquarters outperforms 86% of similar buildings nationwide. It also uses 43% less energy per square foot than the national average.

ENERGY STAR

Certified Building 2023

outperforms 86% of similar

buildings nationwide

per square foot than

the national average

Organization of American States, OAS

Development Bank of Latin America, CAF

National Geographic

IICA

Others

AGE DISTRIBUTION

Silent (Ages 74-91)

Boomers (Ages 55-70)

Generation X (Ages 39-54)

Millenials (Ages 23-38)

Generation Z (Ages 7-22)

IICA $8,993,130

NatGeo $6,793,549

OAS $65,729,568

Members Living in the US

Remote deposits

Members Living abroad

Debit Card transactions

Online Banking users

Total logins

CAF $36,379,530

CUE $1,312,067

IACHR $4,286,745

IICA $8,993,130

NatGeo $6,793,549

OAS $65,729,568

CAF $36,379,530

CUE $1,312,067

IACHR $4,286,745

Loans

Loan Portfolio Growth

CREDIT COMMITTEE REPORT

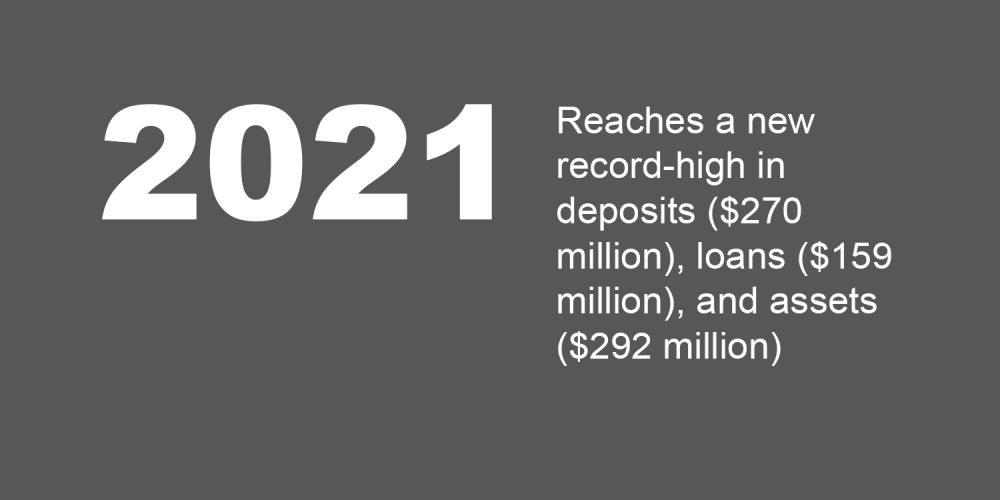

STRONGER NUMBERS

Total Shares

$269,634,084

Total Loans

$159,028,429

Net Worth Ratio: 7.53%

Total Assets

$291,962,032

Luis Raul Betances

Fernando Chaves

Charles U. Edwards.

Guided by the very same mission of serving the global financial needs of our members, after 60 years of service, we are proud to be strong and your financial partner for life. We will continue to invest our resources to deliver outstanding service and benefits so that our members can continue to build an even stronger future.

STRONGER IMPACT

Members

Consumer Loans

Share Accounts

Mortgages & other loans

Club accounts & Share Certificates

Loans Disbursed

Draft Checking accounts

Organizations in our Field of Membership

Titanium Award Recipient

2nd highest award recognizing our outstanding home loan production of over $35 million in 2021.

4th United in Sustainability Summit Co-Hosts

Reached more than 116 credit unions and organizations.

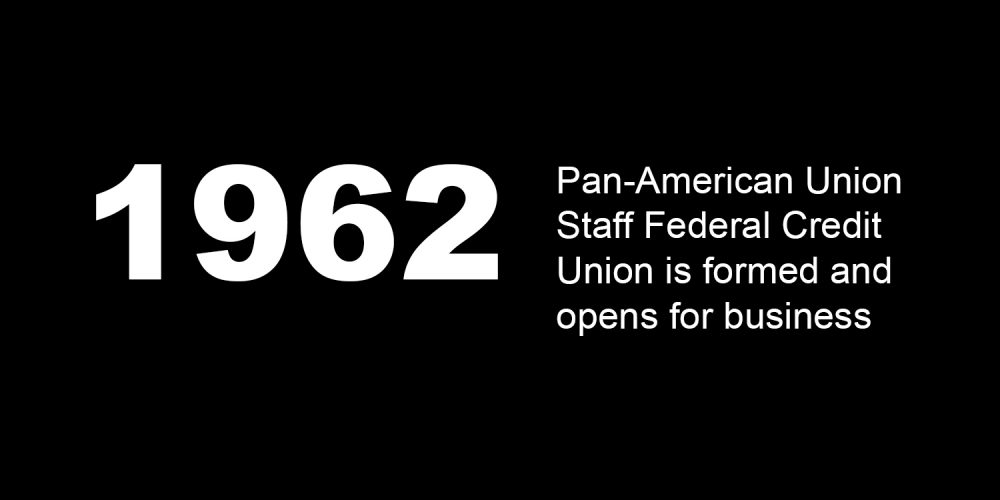

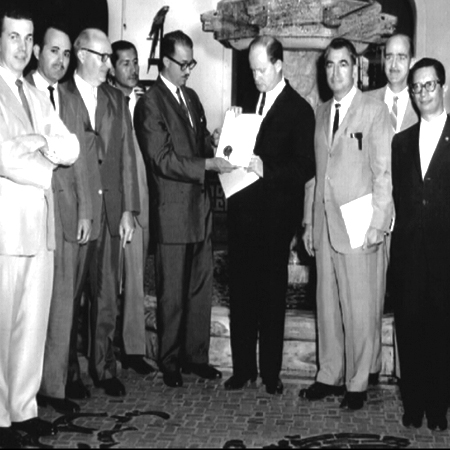

FOUNDING MEMBERS

We want to thank the following individuals who got OAS FCU started and made it possible for all of us to be here today. Sixty years later we’re proud to continue working on our founders’ mission: To deliver the best member experience by combining our distinctive personalized services with relevant technologies. And thank you, our members, for 60 years of trust in their vision, and the work we do.

Luis Raul Betances

Fernando Chaves

Charles U. Edwards.

Philip F. Gallagher

Clarence R. Jauchem

Charles P. Miller.

C.A. Orantes

Felipe Orellana

R.G. Sanchez.

Leon K. Smith

Luis Solorzano

Mario Yuri.

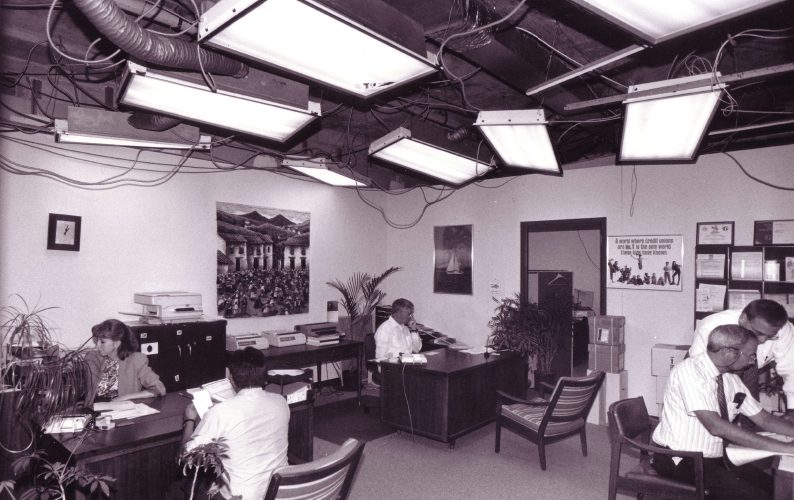

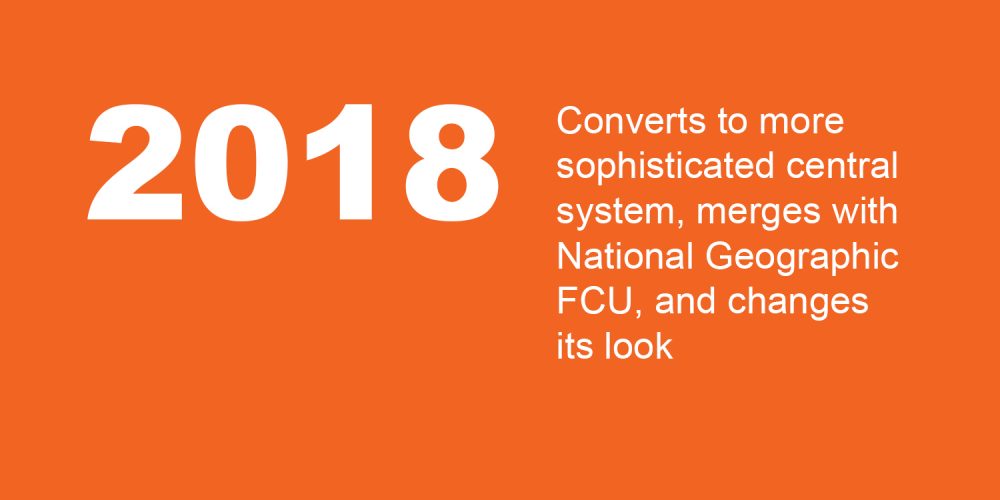

MEMORIES AND MILESTONES

OUR GREAT TEAM

Matt Connors

Lead Dev

Christy Walkins

CSS Guru

Brent Matthews

Project Cordinator

Trisha Johnson

Design ExpertLATEST NEWS

Hello world!

Welcome to WordPress. This is your first post. Edit or delete it, then start writing!...

Chair Message

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec condimentum accumsan ligula, non commodo dolor varius vitae. Morbi dapibus neque a mauris sodales bibendum. Phasellus at ornare tellus. E...

Video Post Format

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec condimentum accumsan ligula, non commodo dolor varius vitae. Morbi dapibus neque a mauris sodales bibendum. Phasellus at ornare tellus. E...

Power Of Social Media

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec condimentum accumsan ligula, non commodo dolor varius vitae. Morbi dapibus neque a mauris sodales bibendum. Phasellus at ornare tellus. E...

Managing Your Time

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec condimentum accumsan ligula, non commodo dolor varius vitae. Morbi dapibus neque a mauris sodales bibendum. Phasellus at ornare tellus. E...

Recent Comments

A WordPress CommenterSays

Hi, this is a comment. To get started with moderating, editing, and deleting comments, please visit the Comments screen in…

adminSays

Yep, that worked. Thanks